Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 11/06/2023

Wheat: Wheat markets were mixed last week and trends are mixed in all three markets. Ukraine is still exporting through the Black Sea. Russia is still exporting and offering Wheat into the world market and is reporting that it is larger than originally thought. Ukraine and the EU countries are offering as well and are getting new business. Demand has been poor for US Wheat as Russia production looks strong, but exports are expected to increase for the rest of the marketing year. Weather forecasts call for drier weather for Australia, with production losses now expected. There are reports of some showers in both countries to raise production estimates slightly but not enough to bring production close to averages. Argentine conditions are reported to be good after a very dry start but showers and rains in recent weeks. It has been too wet in southern Brazil and much of the Wheat grown there is expected to be feed grade instead of milling grade.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed lower last week and trends are now mixed on the daily charts on clear weather in the US to promote active harvest progress against weather problems in Brazil. The dry weather in the central Midwest of the US is expected to return after some snow showers yesterday. It has turned very cold and the growing season is over for almost everyone in the Midwest. Trends are mixed in the market now on the daily charts. Oats closed lower. The US Corn harvest is continuing with good weather and yield reports showing good and bad results with no real trend evident. Farmers report no real sales of Corn as they wait for higher prices. Demand for US Corn in the world market has been very low and domestic demand has been weak due to reduced Cattle and other livestock production. Demand is increasing now. It is already hot and dry in central and northern Brazil and in Argentina although some beneficial rains have been reported in Argentina and a few showers are reported in central and northern Brazil. Southern Brazil is too wet. Conditions are expected to continue to improve over the next couple of weeks as a few showers are expected for Argentina and central and northern Brazil. These will not be enough to save crops but could buy the crops a little time until better rains arrive, hopefully in the near future.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans closed higher last week, but Soybean Meal was slightly lower and Soybean Oil was lower. The trade remains concerned about the weather forecasts for South America. Brazil remains mostly hot and dry in northern areas and too wet in southern areas. Some showers are in the forecast for northern Bazil. Argentina is also dry but has started to get some showers and rains. Yield results for the US new crop show that production and yields are above and below APH data. The data has been called disappointing to traders as production appears to be less than expected so far this crop year. Showers and rains are in the forecast for the rest of the week so harvest progress will be slower. Ideas are that the top end of the yield potential is gone, and severe damage is becoming possible in some areas. Brazil is still selling a lot of Soybeans to China and other countries and reports indicate that the availability of Brazil Soybeans might be ramping down. The US sales to China have ramped up in the last month but have been quiet for the last week or so.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed lower again Friday but was unchanged on the weekly charts as January moved lower to trade in the November range. Near term cash market strength is going against bearish attitudes seen in later months. The harvest is almost over and less Rice is on offer from producers. The export sales report last week was solid but not spectacular. The USDA reports showed little to get excited about either up or down in price. The quality has been uneven with strong field yields but weak milling yields.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower last week on news of reduced Indian imports and ideas of increasing Malaysian supplies. Trends are mixed on the daily charts. Canola closed higher last week. Trends are down on the weekly charts but mixed on the daily charts in this market.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton closed lower last week despite a week of very strong weekly export sales. Macro-economic data for the US was strong as well but demand ideas overall remain weak. Prices are supported by ideas of tight supplies here in the US and around the world. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market. There are production concerns about Australian and Indian Cotton as both countries are likely to suffer the effects of El Nino starting this Fall.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed sharply lower last week, and the trends on the daily charts are down. There are no weather concerns to speak of for Florida right now with the hurricane season all but over and no major storms hitting the state recently. Reports of short supplies in Florida and Brazil are around. Futures are also being supported in forecasts for an above average hurricane season that could bring a storm to damage the trees once again. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures.

Weekly FCOJ Futures

Coffee: Both markets closed higher and New York closed at new highs for the move on reports of logistical problems in Brazil ports. London finished the week with small losses. Showers and rains are now being reported in central and southern growing areas of Brazil and conditions are called good, but many areas have had too much rain, mostly in the south. Demand for Robusta and lower quality Arabicas remains strong. The lack of offers from Asia, mostly from Vietnam but also Indonesia remains a main feature of the market, but the offers are starting to improve with the Vietnam harvest progressing. Offers from Brazil and other countries in Latin America should be increasing

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed higher last week and at new highs for the move on port delays in Brazil and too much rain in central areas of the country. The market is still short of Sugar. There are still forecasts for and reports of rain in Brazil. The market continues to see stressful conditions in Asian production areas. The Brail rains is underway now and have been heavy in the south. There are worries about the Thai and Indian production potential due to El Nino. Offers from Brazil are still active but other origins are still not offering, and demand is still strong. Brazil ports are very congested so shipment of Sugar has been slower.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

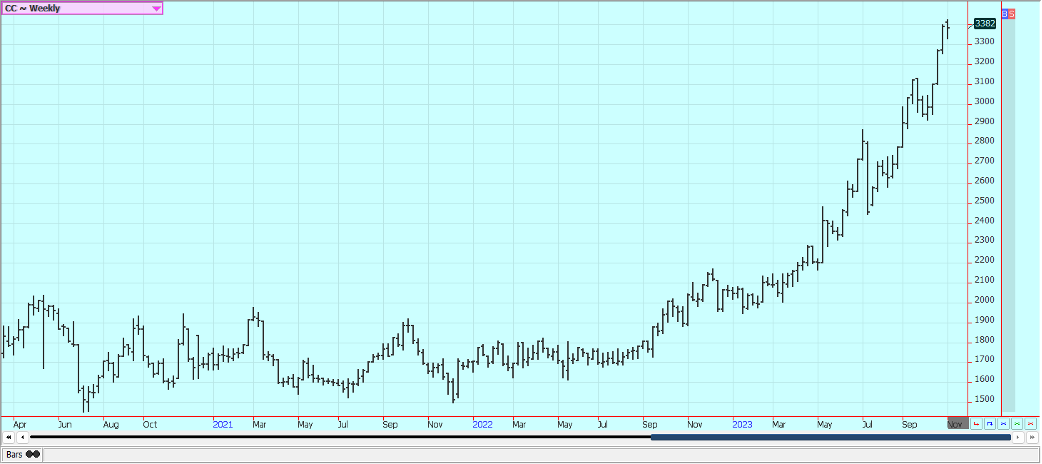

Cocoa: New York and London closed higher Friday but slightly lower for the week. The trends are still up in New York. Traders are worried about another short production year and these feelings have been enhanced by El Nino that could threaten West Africa crops with hot and dry weather later this year. Cocoa arrivals at Ivory Coast ports dropped 16.2% for the marketing year when compared to last year. The main crop harvest comes into focus and as farmers in West Africa report that many areas have too much rain that has caused harvest delays and could lead to disease. Scattered to isolated showers are reported in the region now. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue, Midcrop production ideas are lower now with diseases reported in the trees due to too much rain that could also affect the main crop production.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322