Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 04/22/2024

Wheat: Wheat was lower last week and trends remain mixed in all three markets. The weekly export sales report showed poor sales once again. The problems with Russian Wheat exporters continue but are apparently getting resolved in the governments favor. The reports indicate that the government is seeking more control of the exports and has made life very difficult on the private exporters in an effort to extract more sales and powers to the government. Russia is the world’s largest exporter and sets the world price and prices remain low. Big world supplies and low world prices are still around. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. Black Sea offers are still plentiful, but Russia has been bombing Ukraine again and shipments might be hurt from that origin.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed lower and Oats closed higher last week as traders think that good Spring weather here will greatly increase planted Corn area. Increased demand was noted in all domestic categories, but export demand was left unchanged. South American production estimates were little changed. It is very expensive to plant Corn and Corn is considered unprofitable to plant right now, so planted are might not increase that much if at all. USDA issued its crop progress report for Corn and Corn planting is proceeding slowly. Demand for Corn has been strong at lower prices. Big supplies and reports of better demand are still around, but futures have been very oversold. Funds remain very large shorts in the market.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and the products closed lower last week. Reports of great export demand in Brazil provide some support. Reports indicate that China has been a very active buyer of Brazil Soybeans this season. Ideas that South American production is taking demand from the US have pressured futures lower. Domestic demand has been strong in the US. Funds remain large shorts in the market. The US reports strong domestic demand.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed higher again last week and has rallied back to the contract highs. Trends are up in this market on the daily charts. The market noted good planting and emergence progress in the weekly USDA reports.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower on price action in Chicago. The export pace is expected to continue to really improve but this is part of the price already, in part due to stronger world petroleum prices that have affected world vegetable oils prices as well. Domestic biofuels demand is likely to improve. Ideas of weaker production ideas against good demand still support the market overall. Trends are turning up on the daily charts. Canola was lower in response to the price action in Chicago.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was lower last week on weaker demand ideas. The export sales report showed poor sales once again. USDA made no changes to the domestic supply or demand sides of the balance sheets, but did cut world ending stocks slightly. Trends are still down on the daily and weekly charts. Demand has been weaker so far this year. The US economic data has been positive, but the Chinese economic data has not been real positive and demand concerns are still around. However, Chinese consumer demand has held together well, leading some to think that demand for Cotton in world markets will increase over time.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower last week and futures are at the lower end of a trading range. Reports of tight supplies are around. Florida said that Oranges production will be low, but above a year ago. Futures still appear to have topped out even with no real downtrend showing yet, so a range trade has been seen. Prices had been moving lower on the increased production potential for Florida and the US and in Brazil but is now holding as current supplies remain very tight amid only incremental relief for supplies is forecast for the coming new crop season. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

Coffee: Both markets closed higher on Friday and both are now developing a trading range. The lack of Robusta Coffee in the market is still the main feature. Robusta offers from Vietnam remain difficult to find and the lack of offer of Robusta is a bullish force behind the London market action. There were some indications that Vietnam producers were now offering a little Coffee, but not much and not nearly enough to satisfy demand. Vietnamese producers are reported to have about a quarter of the crop left to sell or less and reports indicate that Brazil producers are reluctant sellers for now after selling a lot earlier in the year. The next Robusta harvest in Brazil is starting now and offers increased yesterday on weakness in the Real.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower last week and trends remain down on the charts as the market seems to have supplies available for sale. There are still ideas that the Brazil harvest can be strong for the next few weeks if not longer. Indian production estimates are creeping higher but are still reduced from recent years. There are worries about the Thai and Indian production, but data shows better than expected production from both countries. Offers from Brazil are still active but other origins. are still not offering in large amounts except for Ukraine. Ukraine offers have suffered lately with the war.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

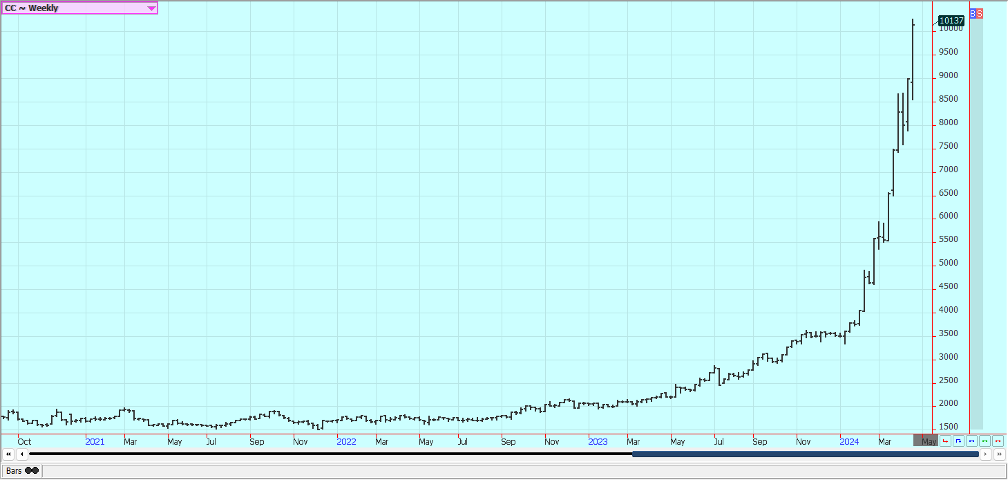

Cocoa: New York and London were sharply higher and at new highs for the move and new contract highs and trends are up. Production concerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting futures. Production in West Africa could be reduced this year due to the extreme weather which included Harmattan conditions. The availability of Cocoa from West Africa remains very restricted and projections for another production deficit against demand for the coming year are increasing. Ideas of tig8ht supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue. Mid crop harvest is now underway and here are hopes for additional supplies for the market from the second harvest. Demand continues to be strong, especially from traditional buyers of Cocoa.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322