Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 01/02/2024

Wheat: Wheat markets were higher last week on new that s commercial ship had hit a mine in the Black Sea. That report came on the heels of reports that a Russian naval ship had been bombed in Crimea. The news caused an immediate reaction in Wheat futures as this could mean an escalation in the fighting is now possible. Black Sea offers are still plentiful and Russian prices appear to be about 260.00 per tons FOB. News that Argentina will restructure its economy with a shock devaluation of the peso and structural changes inside the country created ideas that farmers would sell, but it is unlikely they will sell right away and might be better off to wait and see a more calm situation. EU countries are offering as well and are getting new business. Demand has been poor for US Wheat as Russia production looks strong, but exports are starting to increase.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed a little lower last week in range trading. The market anticipates increased selling from producers, but many have sold enough and elevators and processors are reported to be full. Producers are also looking for higher prices now as crops are in the bin for the Winter. Oats were higher. Ideas of weak demand are keeping prices low over all, but the weekly export sales reports have shown good demand for the last several weeks. The market feels that there is more than enough Corn for any demand and are not buying futures despite the improve demand. It is still hot and dry in central and northern Brazil and in Argentina although some showers have been reported in Argentina and in central and northern Brazil. These conditions could change this week as significant rains are forecast for central and northern areas.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and the products closed lower, with Soybean Meal the weakest on increasing confidence that Argentina will return as a major exporter and as US crushers are crushing for oil and have a lot of extra meal available. There are some forecasts for significant rains and rains this week in central and northern Brazil and less wet conditions in the south. The trade remains concerned about the weather forecasts for South America but is holding to ideas of production well over 150 million tons. Our source suggests that production in Brazil could be much less due to the extreme weather seen already. Brazil has been mostly hot and dry in northern areas and too wet in southern areas. Argentina crops are reported o be in good condition with enough moisture. These weather trends are expected to continue after next week.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed lower last week and trends started t turn down on the daily charts. Farmers appear quiet in the market and basis levels are reported to be steady, but industry and speculators have been busy. Most farmers are hunting and getting ready for the holidays and are not interested in Rice markets. Demand reports have been solid to strong for the last couple of weeks and have featured traditional buyers in Latin America and Asia.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was slightly lower last week on ideas of weaker demand for Palm Oil as the private sources reported improved demand for Palm Oil and as the weather situation is good for production. There had been concerns about too dry weather caused by El Nino. Production was high in the MPOB reports but is expected to drop seasonally in future reports. Trends are sideways on the daily charts and are sideways on the weekly charts. Canola was a little higher last we3ek in spite of late week selling inspired by end of the year trading and a change in the Brazil weather forecasts. Current forecasts call for drier weather in southern Brazil and wetter weather in central and northern areas this week. The Canola crop is harvested and it is in bins, so it will take some price movement to get new farm sales. Trends are mixed on the daily charts in this market.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton closed a little higher last week in sideways trading. USDA released its weekly export sales report and the volumes sold were big and included some significant sales to China. The US economic data has been positive, but the Chinese economic data has not been real positive and demand has been down. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market. There are production concerns about Australian and Indian Cotton as both countries are likely to suffer the effects of El Nino starting this Fall, but Brazil production prospects are said to be very strong.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed mostly lower last week and the market continues to correct from the huge rally now completed. January closed higher before deliveries start next week. The moves imply that supply is finally getting bigger than demand and implies that consumer demand has dropped significantly in recent weeks. There are no weather concerns to speak of for Florida right now with the hurricane season all but over and no major storms hitting the state recently. The weather has improved in Brazil with some moderation in temperatures and increased rainfall in the forecast for this week. Brazil got more than expected rains over the weekend. Reports of short supplies in Florida and Brazil are around. Historically low estimates of production in Florida due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures.

Weekly FCOJ Futures

Coffee: Both markets absorbed some significant selling late last week to close the week lower. Brazil production areas are now expected to see some very beneficial rainfall over the coming week. Arabica and Robusta areas are affected by drought but the current forecasts call for a lot of help in affected areas. Espiritu Santo is the most affected state, but all states are being hurt to some degree. Brazil weather remains uneven for the best crop production, but there are reports of increasing Coffee availability from Vietnam. The weekly continuation chart for New York shows a gap that would be filed by trading down to 183.75 basis March futures.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York closed slightly lower last week and London closed a little higher. There are problems with Sugar availability at this time. Brazil weather forecasts now call for wet in the south and continued isolated to scattered showers in central and northern areas this week. The market continues to see stressful conditions in Asian production areas but has noted that India has changed its Ethanol policy to make more Sugar available to the market. There are worries about the Thai and Indian production potential due to El Nino and talk that India could turn into an importer next year. Offers from Brazil are still active but other origins. are still not offering or at least not offering in large amounts except for Ukraine, and demand is still strong. Brazil ports are very congested, so shipment of Sugar has been slower.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

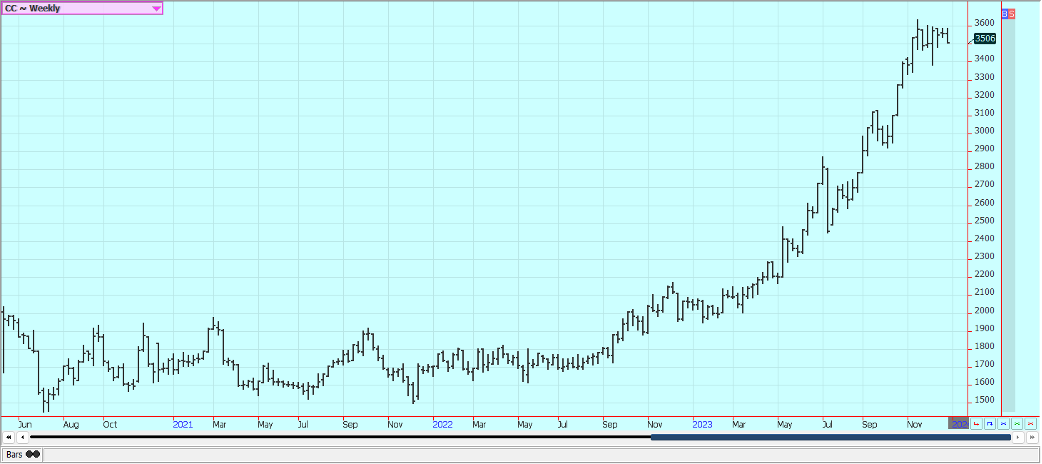

Cocoa: Both markets closed lower and near the lows of the week as funds and other trade interests sold to square up positions before the end of the year. Trends have been up but tops could finally be forming. Traders are worried about another short production year and these feelings have been enhanced by El Nino that could threaten West Africa crops with hot and dry weather later this year. The main crop harvest is starting in parts of West Africa so the losses will become minor for now. Scattered to isolated showers are reported in the region now and the harvest is coming. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue,

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322