Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 09/30/2024

Wheat: All three markets closed a little higher last week. World prices were stable amid weather problems here in the US and around the globe. USDA will update production later today in the Small Grains Report. Ideas are that the Great Plains are too hot and dry for best Wheat development are still around as the Winter crop gets planted. It is also hot and dry in western Canada. Cash markets in Russia were unchanged even as production estimates have dropped to about 82 million tons and prices in Europe have been near unchanged so far this week. Ideas of good crops just harvested in the US and Canada went against reports of dry weather in eastern Europe and Russia and too wet weather in France and Germany along with Spring Wheat areas of Russia are still heard and the weather there affecting world production estimates. There were more reports of dry conditions coming this week to Russian growing areas although Spring Wheat areas have seen too much rain. Eastern Europe is also hot and dry. Western Europe has seen too much rain.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn and Oats closed higher and just off the highs of the day and the week. It remains dry in the Midwest, although there are forecasts for some showers and cooler temperatures in the Midwest this weekend. Ideas are that the production data will be the biggest seen all year due to the dry August and September in most of the Midwest. Producers plan to hold new crop supplies in hopes for higher prices. Ideas of very strong yields are still heard and harvest is under way. Yield reports heard so far show strong but not spectacular production potential for the national crop. Increased US demand comes from the fact that Corn prices are already the cheapest in the world. Current forecasts call for drier weather for the Midwest for the week or longer to hurt kernel fill and ear weights.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Meal were higher last week after a sharp rally on Friday that appeared to be led by fund short covering tied to positioning for the end of the month and quarter today. Soybean Meal closed the week with very slight gains. Warm and dry weather in the Midwest recently has hurt production ideas due to ideas of small beans in the pods although there have been spotty showers more recently. Dry weather is expected to return this week. Ideas are that the production reports are the biggest that will be seen this year. There is concern about the dry weather seen in the Midwest could hurt pod fill. Ideas are that the beans could be smaller in the pods, but this will not be seen in this report that will include mainly pod counts. Bean sizes will be measured in subsequent months. Central and northern Brazil has also been dry and reports indicate that soil moisture levels are at 30 year lows. Soils are in much better shape in southern Brazil and Argentina. There are some forecasts for showers to return to central and northern areas in a couple of weeks. Reports indicate that China is buying a lot in the US but the country will be on holiday this week so no new demand is expected.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed lower last week on weather concerns. A hurricane came late in the week in the southern US and hit rice areas in the northern Delta with a lot of wind and rain. There was concern to damage to unharvested crops in the region. The US weather has been an issue much of the growing season with too much rain early in the year. Some areas are now too hot and dry, especially in Texas, and Texas yields are down as the harvest is now over in the state.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil started the week lower and closed higher higher on ideas of weakening production and reports of improving export demand despite news that India had increased Palm Oil import taxes. There is talk of increased supplies available to the market, and the trends are mixed on the daily charts. Canola was higher all last week in response to StatsCan production data and the weather in Brazil which has been very dry in central and northern areas. The weather has been hot and dry in Canada and it looks like Canola production has been impacted. The weather has called for dry conditions in the Prairies and yields are expected to be the same or less. Demand concern remain at the forefront with less demand expected from China with that country now in a trade war with Canada.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was a little lower last week as continued stressful weather was seen in the south. There are still ideas of weaker demand potential against an outlook for improved US production in the coming year. There have been demand concerns about Bangladesh and China and ideas are that production is strong enough. The Delta should have the best looking crops right now, but crops in other areas are more suspect. Texas and the Southeast have seen some extreme heat so far this year, and Texas has also seen dry conditions at times during the growing season. Demand has been weaker so far this year but there are hopes for improved demand with the lower prices.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed lower again last week as the hurricane hit Florida but missed most production areas. A new tropical system is a category 4 storm but moved very quickly north. The northern half of the state was the most affected. A very active year has been forecast but has yet to come true. The market remains well supported in the longer term based on forecasts for tight supplies in Florida. The reduced production appears to be mostly at the expense of the greening disease. There are no weather concerns to speak of for Florida or for Brazil right now although reports indicate that Brazil is hot and dry. Ideas are that demand has suffered recently with the move to extremely high prices.

Weekly FCOJ Futures

Coffee: Both markets were higher last week and both markets made new contract highs on the daily charts and New York made new highs on the weekly charts on Thursday as the dry Brazil and Vietnam weather patterns remained the main focus. More reports of dry weather that could be hurting production potential had been supporting futures in both markets. Indonesian offers are still less as producers wait for higher prices before selling. Damage was done to crops earlier in the growing season in Vietnam and lower production is now expected for the next crop. It is still dry there.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York closed a little higher and London closed lower last week. New York failed to hold at new contract highs and London could not make new contract highs set early in the week. More reports of burning crops in Brazil and on dry conditions seen generally in Brazil continued to support both markets overall. Harvest progress in Brazil and improved growing conditions in India and Thailand are the important fundamentals and growing conditions are dry in Brazil. Indian and Thai monsoon rains have been very beneficial and mills are expecting strong crops of cane. Thailand now expects to produce 20.3 million tons of Sugar, up more than 18% from last year. India also expects strong production after good monsoon rains this year.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

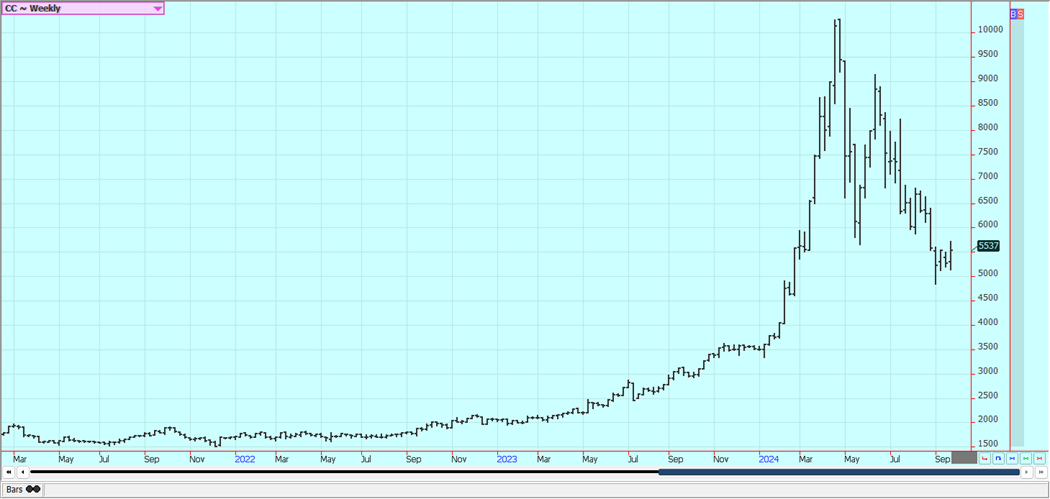

Cocoa: New York and London closed higher last week and New York filled a gap on the weekly charts that was left a couple of weeks ago. There are still ideas of tight supplies available to the market now as production for the next crop looks to be improved. However, news reports indicate that governments in West Africa have been forcing producers and traders to liquidate stocks and make more available to the market. Production in West Africa could be stronger this year on currently wetter weather in Ivory Coast. Above average rain is now forecast for the next couple of weeks to improve conditions in West Africa. The availability of Cocoa from West Africa remains very restricted, but surplus production against demand is expected in the next crop year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322