Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 04/08/2024

Wheat: Wheat was mixed last week, with SRW and Spring Wheat higher but HRW lower. Trends turned up in SRW but remain mixed in HRW and Spring The USDA reports released a week ago were considered friendly. USDA said that All Wheat plantings would be about 47.5 million acres, with the big reductions seen in Winter Wheat. In contrast, Spring Wheat plantings were above the trade guesses at 11.335 million acres. Inventories were just above the average trade guess and 1.083 billion bushels. The weekly condition report a week ago showed good conditions and the weekly export sales report was poor. The problems with Russian Wheat exporters continue. The dispute has held up shipments of at least 400,000 tons of grain so far. The reports indicate that the government is seeking more control of the exports and has made life very difficult on the private exporters in an effort to extract more sales and powers to the government. Russia is the worlds largest exporter and sets the world price and prices remain low. Big world supplies and low world prices are still around. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. Black Sea offers are still plentiful.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn and Oats closed lower last week as traders think that good Spring weather here will greatly increase planted Corn area. This might not be true as it is very expensive to plant Corn and Corn is considered unprofitable to plant right now. USDA issued its first crop progress report for Corn early last week. The USDA reports released more than a week ago showed inventories and planting ideas below trade expectations. USDA said that plantings should be just 90 million acres and that inventories are estimated at 8.347 billion bushels. The plantings intentions report was especially bullish for Corn prices. Demand for Corn has been strong at lower prices. Big supplies and reports of limited demand are still around, but futures have been very oversold. Futures are much lower than just a few months ago and a short covering rally is increasingly expected and might start next week. Funds remain very large shorts in the market. Basis levels have firmed a little bit in the US as processors look for supplies amid tight farmer holding patterns. The weather forecasts for Argentina are improving with drier weather expected this week after some big rains last week. More rain is forecast for central and northern Brazil, but dry weather is forecast for southern Brazil The planting progress reports to date indicate rapid progress and reports from Brazil indicate that the Winter crop has been mostly planted now.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed a little lower last week and Soybean Oil was a little higher after all three markets absorbed some early week selling pressure. Brazil producers had been taking advantage on higher futures in the US and higher basis levels in Brazil, but the basis has fallen sharply in Brazil this week and sales have been less. Reports of great export demand in Brazil provide some support. Reports indicate that China has been a very active buyer of Brazil Soybeans this season. Ideas that South American production is taking demand from the US have pressured futures lower. Funds remain large shorts in the market. Basis levels in the US are reported to be firming as processors look for supplies and farmers remain tight holders.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed lower last week after making new lows for the move and testing important support near 1600 May. Futures turned sideways after the big move lower. Trends are mixed in this market on the daily charts. The market noted good planting and emergence progress in the weekly USDA reports released on Monday afternoon. Good demand for exports continues. The overseas markets feature less production in Brazil and India, and it appears that the lack of offer from these markets is supporting increased demand for US Rice and prices here in the US. It turning drier and warmer in the US this week and fieldwork should become active.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was higher last week on strong export data for the month from private sources. The export pace is expected to continue to really improve but this is part of the price already, in part due to stronger world petroleum prices that have affected world vegetable oils prices as well. Domestic biofuels demand is likely to improve. Ideas of weaker production ideas against good demand still support the market overall. Trends are turning up on the daily charts. Canola was higher last week in line with rallies in Chicago Soybean Oil and Malaysian Plam Oil. There were reports of good growing conditions in Argentina. Current forecasts call for generally improved growing conditions in Brazil this week.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton was lower Latz week, and trends are down on the daily and weekly charts on concerns about the planting intentions report released a week ago and despite improving ideas of demand potential from China. Demand has been weaker so far this year. USDA said that 10.7 on acres might get planted this year, from 10.2 million last year. It is too early to plant in Texas but the heat and dry weather raises concerns about production potential later in the growing season and blackened soils might not permit much planting, anyway. The demand news has been reduced from previous levels in this market for the last several weeks. The US economic data has been positive, but the Chinese economic data has not been real positive and demand concerns are still around. However, Chinese consumer demand has held together well, leading some to think that demand for Cotton in world markets will increase over time.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower last week and remains in a trading range. Reports of tight supplies are around. Florida said that Oranges production will be low, but above a year ago. Futures still appear to have topped out even with no real downtrend showing yet, so a range trade has been seen. Prices had been moving lower on the increased production potential for Florida and the US and in Brazil but is now holding as current supplies remain very tight amid only incremental relief for supplies is forecast for the coming new crop season. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested.

Weekly FCOJ Futures

Coffee: Both markets closed much higher last week and both show up trends on the daily and weekly charts. The lack of Robusta Coffee in the market continues to support futures. Robusta offers from Vietnam remain difficult to find and the lack of offer of Robusta is a bullish force behind the London market action. There were some indications that Vietnam producers were now offering a little Coffee, but not much and not nearly enough to satisfy demand. Vietnamese producers are reported to have about a quarter of the crop left to sell or less and reports indicate that Brazil producers are reluctant sellers for now after selling a lot earlier in the year. The next Robusta harvest in Brazil will start next month. Brazil weather continues to improve for Coffee production and conditions are called good.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower last week on ideas that the Brazil harvest can be strong for the next few weeks if not longer. Ideas of stronger demand have surfaced to provide support. Indian production estimates are creeping higher but are still reduced from recent years. There are worries about the Thai and Indian production. Offers from Brazil are still active but other origins. are still not offering in large amounts except for Ukraine. Ukraine offers have suffered lately with the war. Demand reports from Europe have been strong.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

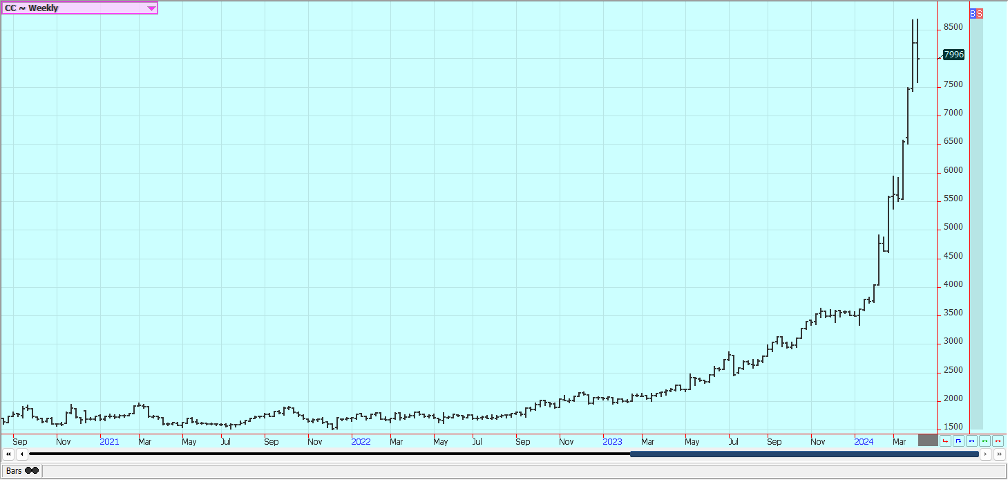

Cocoa: Both markets were lower last week y. and finally started to consolidate the massive gains from the recent rally. A short term top is possible but far from guaranteed. Production concerns in West Africa as well as demand from nontraditional sources along with traditional buyers keep supporting futures. Production in West Africa could be reduced this year due to the extreme weather which included Harmattan conditions. The availability of Cocoa from West Africa remains very restricted and projections for another production deficit against demand for the coming year are increasing. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue. Ivory Coast arrivals are now 1,301 tons, down 26.7% from the previous year. Mid crop harvest is now underway and here are hopes for additional supplies for the market from the second harvest. Demand continues to be strong, especially from nontraditional buyers of Cocoa.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322