Jack Scoville

Jack Scoville is an often quoted market analyst in the grain and soft commodities sectors. You will find his commentary throughout the Reuters, Wall Street Journal, Dow Jones, Bloomberg, and Barron's publications. Contact Mr. Scoville at (312) 264-4322

Translate

Weekly Ag Markets Update – 02/20/2024

Wheat: Wheat was lower last week on big world supplies and low world prices. USDA said in its outlook forum that planted area should be about 47 million acres, from 49.6 million this year. Yields were increased, so production was pushed to 1.9 billion bushels and ending stocks were pushed higher to 769 million bushels. Export sales remain weak on competition from Russia, Ukraine, and the EU as those countries look to export a lot of Wheat in the coming period. EU offers were unchanged to help keep US offers from falling. Russian and Ukraine offers are weaker. Some support came from the bombings in the Red Sea that has interrupted commerce. It is warm in the US and Canada this week. Cooler temperatures are also forecast for next week. Black Sea offers are still plentiful and Russian prices appear to be weakening.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn was lower last week and Oats were higher. USDA estimated planted area for Corn at 91.0 million acres, from 94.6 million last year. Yields were trendline and high, so production held at 15.040 billion bushels and ending stocks were pushed higher to 2.632 billion bushels. The weather forecasts for Argentina are improving with more showers expected this week but coming after a hot and dry period first. On the other hand, more rain is forecast for central and northern Brazil and the Soybeans harvest could be delayed and that could mean less Corn planted area The planting progress reports to date indicate rapid progress so this concern is lessening. Soybean quality could be reduced as well. The market anticipates increased selling from US producers, but many have sold enough, and elevators and processors are reported to be full. Producers are looking for higher prices now as crops are in the bin for the Winter. Ideas of weak demand are keeping prices low. The market feels that there is more than enough Corn for any demand.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and the products were lower last week and trends started to turn down on the daily charts. USDA showed increased planted area at its Outlook Forum at 87.5 million acres, from 83.6 million last year. Yield estimates were high at 52.0 bushels per acre and production was also high at 4.505 million bushels. Ending stocks were projected at 435 million bushels, from 315 million forecast for this year. Rains are in the forecast after the extreme weather seen over the next week in Argentina. Such rains would be beneficial for reproducing Corn and Soybeans. The precipitation keeps falling in Brazil and is expected to continue through this week. The rains could be detrimental to the quality Soybeans and the planting dates for Winter Corn. Support also came from reports of reduced Brazil production.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice closed lower last week despite strong demand for exportz as USDA showed increased production potential and increased ending stocks ideas in its Outlook Forum. Trends are mixed on the daily charts. The overseas markets feature less production in Brazil and India and it appears that the lack of offer from these markets is supporting increased demand for US Rice and prices here in the US. Warmer and wetter weather is expected this week and next on the Delta and Texas and soil moisture conditions for the next crop should improve.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil was lower last week on price action in Chicago. Ideas of weaker production ideas against good demand still support the market ove4rall. MPOB said that January stocks were 2.02 million tons, down 11.8% from December. Exports were stronger than expected and production was a little weaker. The fundamentals of average demand against a weaker supply outlook are still around to keep prices supported. Trends are mixed on the daily charts and on the weekly charts. Canola was lower with Chicago. There are still forecasts for better rains in Argentina after a dry spell ends in a week or so and improving weather in Brazil. Current forecasts call for generally improved growing conditions in Brazil this week. The Canola crop is harvested, and it is in bins, so it will take some price movement to get new farm sales. Trends are trying to turn down on the daily and weekly charts in this market.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton closed higher last week and the price action was strong as futures built on the gains seen the previous week and confirmed a strong new up trend has developed. The weekly export sales report showed solid sales and sales are expected to continue strong in the world market for the future. The demand news has been solid in this market for the last several weeks. USDA in its Outlook Forum estimated Cotton planted area and production higher. Demand was also higher but ending stocks showed a slight increase. The charts indicate that trends turned up in the second half of last week. Reports indicate that the US cash market has been moderately active with some producer selling and mill fixing noted. The US economic data has been positive, but the Chinese economic data has not been real positive and demand concerns are still around. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market but recent demand from China is starting to put those concerns on the back burner.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed a little lower last week but well off the lows of the week. The daily charts suggest once again that the market is finding a high area, and daily chart trends ar3e mixed. Prices had been moving lower on the increased production potential for Florida and the US and also in Brazil, but held late last week as current supplies remain very tight amd only incremental relief for supplies is forecast for the coming new crop season. There are no weather concerns to speak of for Florida or for Brazil right now. The weather has improved in Brazil with some moderation in temperatures and increased rainfall amid reports of short supplies in Florida and Brazil are around but will start to disappear as the weather improves and the new crop gets harvested. Historically low estimates of production in Florida due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures.

Weekly FCOJ Futures

Coffee: New York and London closed lower last week, with London the leader as forecasts for good growing conditions through the month of February continue. Robusta offers remain difficult to find and the lack of offer of Robusta remains the main bullish force behind the market action, and reports indicate that Brazil producers are reluctant sellers as well as they apparently have already sold a lot. Also, exchange inventories remain reduced, indicating that futures are too far below cash values to entice people to register for delivery to the exchange. Brazil weather continues to improve for Coffee production but is still not perfect. Rains continued to fall in parts of Brazil Coffee areas. Brazil weather is improving for the best crop production.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London closed lower last week and the trends are turning down on the daily and weekly charts. The market continues to see stressful conditions in Asian production areas. There are worries about the Thai and Indian production and talk that India could turn into an importer next year. Offers from Brazil are still active but other origins. are still not offering or at least not offering in large amounts except for Ukraine. Unica in Brazil said that mills crushed 714,000 tons of Sugarcane in the second half of January, up 132% from last year. Sugar production was 28,000 tons and Ethanol production was 313 million liters.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

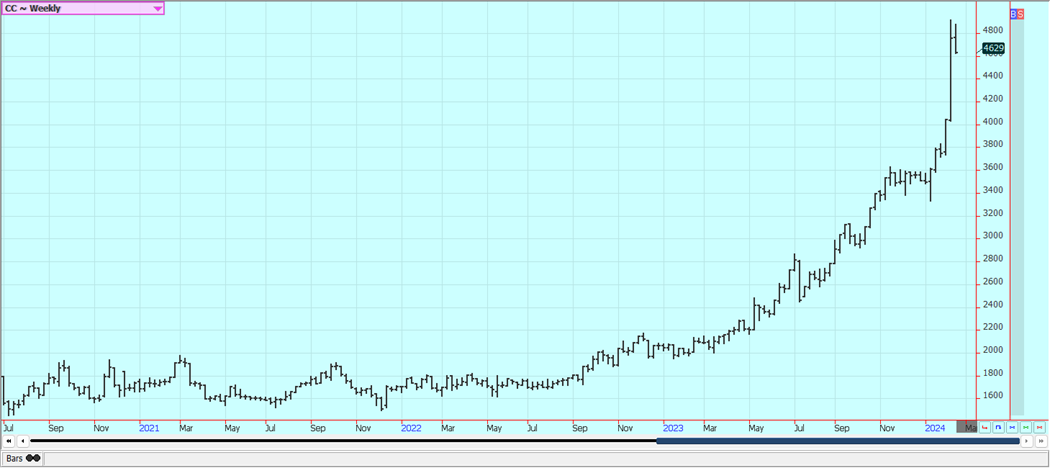

Cocoa: Both markets were lower last week but kept the short term trends up. Price trends remain mostly up on the daily and weekly charts. Futures have rallied sharply for the past month but exploded higher last week. The availability of Cocoa from West Africa remains restricted and projections for another production deficit against demand for the coming year are increasing. The harvest seems to be coming and demand could be a problem with the current very high prices. Traders are worried about another short production year and these feelings have been enhanced by El Nino that is threatening West Africa crops with hot and dry weather. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue,

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Questions? Ask Jack Scoville today at 312-264-4322